The exorbitant prices of Taylor Swift concerts are yet another example of how the culture industry has become a never-ending cycle of profiteering. Live Nation Entertainment, the industry giant, encourages rate-hiking tactics and faces accusations of monopoly.

The Taylor Swift phenomenon has returned to Europe after more than a decade. The American pop star has unleashed the ‘Swifties’ fever, and wherever she goes she is sold out. Such is the demand for tickets that in some cases she has announced more than one date, as in Madrid.

Her time on the dance floor has left its mark. The concerts have been surrounded by controversy because of the prices, which are not for everyone: the cheapest tickets are €85 in the rear amphitheatre – bring your binoculars – and the most expensive (non-VIP) are €226.50 on the front stage. VIP tickets range from €282 to €489. The high demand and the limited supply through one channel encourage the resale bubble, concerts have gradually taken the form of a new speculative element, making prices far from democratic. A parallel market is created, which pushes prices up and creates a cycle of rising prices. Moreover, if the purchase is not made through official channels, the risk of fraud is high. Spend more money and on something uncertain.

On X (Twitter), a quick search for ‘Taylor Swift tickets’ found tickets for a staggering €8000. On resale sites such as StubHub or Viagogo, tickets were available for 20,000 euros. Beyond the madness of the resale market, the palm of the hand goes to the Hotel VP Plaza España, which offered three exclusive packages including two nights in its 120 square metre presidential suite and two VIP tickets to Taylor Swift’s concert for the price of 30,000 euros.

The US star’s concerts are yet another indication of the trend in the culture industry, which is increasingly resembling the property market. The general bubble is reaching a critical point, on the verge of bursting. Ticketmaster, a global company that facilitates the sale of tickets for live events, is at the centre of the controversy.

Taylor Swift dismantling the Monopoly board

In 2010, Live Nation, a concert promoter and event management company, merged with Ticketmaster to form Live Nation Entertainment. The deal combined the capabilities of Ticketmaster, the ticketing channel, with Live Nation’s expertise in event production and promotion, concentrating power in different parts of the process from production to distribution.

There are downsides to so much of the market, and Taylor Swift was the catalyst for the chaos: the technological meltdown and massive price inflation after she sold millions of tickets in one day in the US was the straw that broke the camel’s back. It’s time to restore competition and innovation to the entertainment industry. It’s time to break up Live Nation-Ticketmaster,’ said Attorney General Merrick Garland after the US Department of Justice filed a lawsuit accusing the company of monopolistic practices.

In its lawsuit, the DOJ said Live Nation Entertainment directly manages more than 400 music artists and dominates about 60 percent of concert promotion at major venues nationwide. It also operates more than 265 concert venues in North America, while its closest competitor owns only a handful of top-tier amphitheatres. The Department also notes that Live Nation, through Ticketmaster, controls approximately 80% or more of the sales of major concert tickets at major venues, and notes that it even controls an increasingly large share of the resale of tickets on the secondary market.

The ‘Swifties’ disaster prompted Ticketmaster to apologise to the artist and her fans. After hours of waiting for the advance sale, tickets appeared on the secondary market for thousands of dollars.

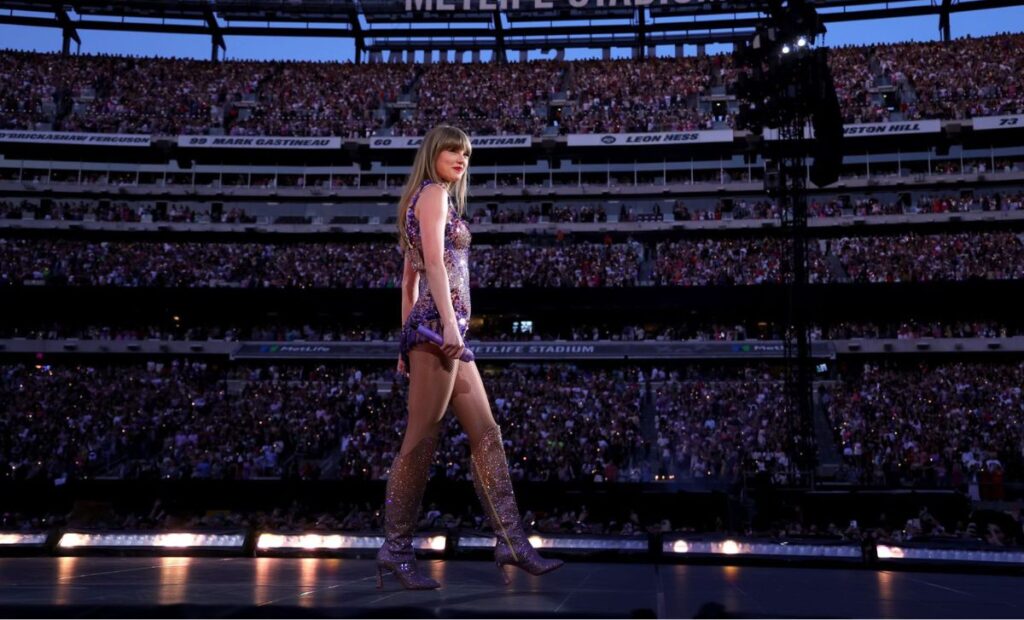

The stadium during a concert, the new model of social stratification

Arrive early with a survival kit – sandwich and crisps – to queue for a privileged place with your general admission ticket to the arena: the coveted front rows. The commodification of space is another issue exploited by the music industry, which has come up with the idea of putting a fence around the arena, demarcating the most sought-after territory, and making it available to the public by raising the price and calling it the front stage. So, if you have a regular ticket, you queue up to get the front row behind the front row – paid for.

As in an amusement park, the logic is ‘pay more, secure your place and save the queue’. The all-inclusive wristband to be the master of the crowd. This system of dividing up the audience according to economic ranks has already caused some controversy, as in the case of a summer festival in Spain, when a video went viral of a man on the front stage deliberately trying to block the view of the people behind him, the people on the dance floor, calling them ‘plebs’. Several artists have expressed their discomfort with this segmentation: another paradigmatic case of the summer was when singer Juancho Marqués spoke out against this business model at a festival and came to sing directly with the people on the dance floor, or the Lori Meyers concert at WiZink, where the segmentation of the seating capacity had to be eliminated after criticism from the fans.

On average, Front Stage prices are 30-40% higher than regular arena prices. This is also the case for Taylor Swift in Madrid, from 170 euros for a general admission ticket to 226.50 euros for a Front Stage ticket, a difference of almost 34%. And all this considering that Front Stage is not a VIP pass. The stadiums during a concert are the new model of social stratification.

Dynamic pricing or how to manage a concert with the logic of an airline

The influence of the ‘dynamic pricing’ policy common in the United States adds fuel to the fire. If many people buy tickets at the same time, prices can rise significantly and become unaffordable. To illustrate, it can be compared to buying a flight or booking a hotel. The longer we wait, the closer the date, the more people buying at the same time or the greater the interest in the destination, the more the price rises, often instantaneously.

Dynamic pricing has been a key factor in other record-breaking price increases, such as that of Bruce Springsteen. When he announced a US tour after a six-year hiatus, fans were stunned to see ticket prices as high as $5,000. Faced with complaints from fans, Ticketmaster in the US issued a statement explaining that when there are many more people wanting to attend an event than there are tickets available, prices go up. In other words, they applied dynamic pricing.

In Spain, this strategy is already being applied, but not to all tickets. For example, VIP tickets are not subject to this system, so if there is a lot of demand for regular tickets at the same time, the price could even exceed that of the exclusive tickets. The CEO of Ticketmaster Spain, Ana Valdovinos, explains that the fact that this policy is applied “is decided by the promoters and the artists”, adding that it is usually applied to “events with high demand” and that “dynamic pricing is used to adjust this demand”. In other words, the more people want it, the more expensive it will be.

Live Nation, a fortress in a bubble

In the face of Live Nation’s excessive power and opacity, the European Commission is creating a new regulatory framework in the Digital Services Act, which will apply from January 2024. This poses some challenges for the entertainment giant, particularly in terms of pricing transparency. Dynamic pricing could come under scrutiny, as event management and distribution companies will now have to provide clarity on how ticket costs are determined.

In addition, Live Nation will have to put in place mechanisms to eliminate fraudulent tickets – to avoid suspicion, as was the case when pre-sales for Swift in the US did not work well and a resale market for tickets emerged in parallel – ensure that its advertising is fully transparent and, in general, better protect consumers. However, greater transparency does not necessarily mean a ban on business models such as dynamic pricing or audience segmentation, or a consequent reduction in prices for consumers.

So, with legal fronts open on the one hand and legislative pressure on the other, Live Nation remains in its bubble, which, as it grows, is getting closer to bursting.